Malaysia Net Salary Calculator

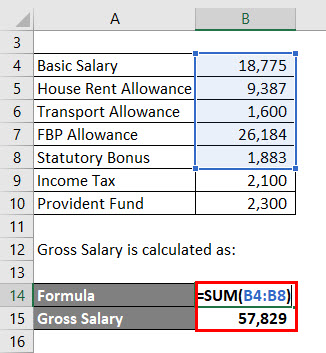

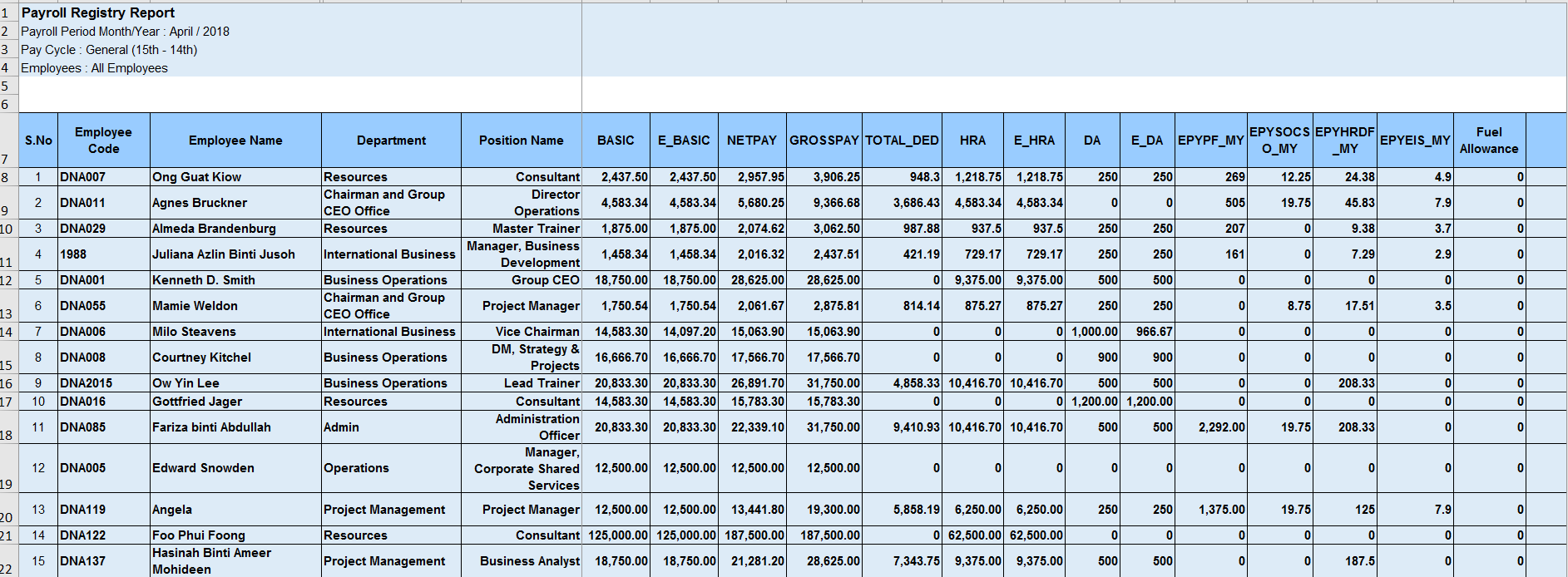

Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia.

Malaysia net salary calculator. Income tax calculator for non resident individuals xls 67kb compute income tax liability for non resident individuals locals and foreigners who are in singapore for less than 183 days 6. Getnetmonthlysalary currency rm about simple pcb calculator pcb calculator made easy. Your average tax rate is 21 30 and your marginal tax rate is 11 50 this marginal tax rate means that your immediate additional income will be taxed at this rate. A free calculator to convert a salary between its hourly biweekly monthly and annual amounts.

Calculate your income tax in malaysia salary deductions in malaysia and compare salary after tax for income earned in malaysia in the 2020 tax year using the malaysia salary after tax calculators. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available. Pcb stands for potongan cukai berjadual in malaysia national language. This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus only tax.

Pcb stands for potongan cukai berjadual in malaysia national language. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed. If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582 that means that your net pay will be rm 59 418 per year or rm 4 952 per month. Nor status calculator xls 89kb.

If monthly salary is rm 5 000 with a yearly bonus of rm 5 000 then for an employee who is not married the combined tax for both salary and bonus is rm 650. Adjustments are made for holiday and vacation days. Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes.

Experiment with other financial calculators or explore hundreds of individual calculators covering other topics such as math fitness health and many more. Area representative travel calculator xls 46kb compute number of business days for area representative scheme. Getnetmonthlysalary currency rm about simple pcb calculator pcb calculator made easy. If you make s 85 200 a year living in singapore you will be taxed s 18 148 that means that your net pay will be s 67 052 per year or s 5 588 per month.