Epf Account 1 Withdrawal Calculator

Under the law the employees provident fund organisation of india or efpo controls the funds deposited by both the employee and employer in a permanent account affixed by an uan or unique account number.

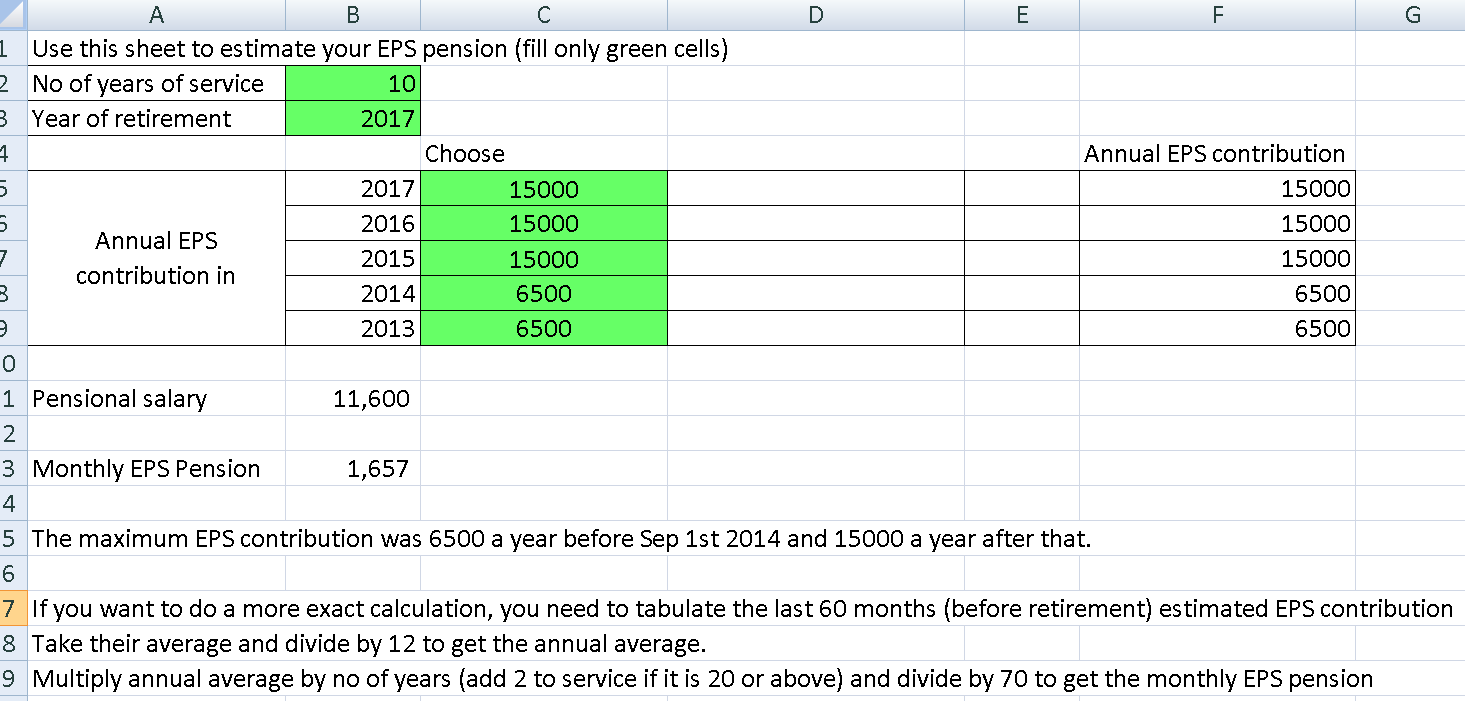

Epf account 1 withdrawal calculator. A 10 rate is applicable in the case of establishments with less than 20 employees sick units or units that meet certain. Employers match employees pf contribution. An epf calculator can help you estimate your savings appropriately. Your present age and the age when you wish to retire.

The minimum amount of savings that can be withdrawn is myr 1 000 and can be made at intervals of 3 months from the last transfer subject to the availability of the basic savings requirement in account 1. Balance in account 1 rm. Epf mis calculator tips based on latest epf basic savings starting january 1 2019. Epf mis withdrawal mis provides an option for members to invest a portion of their epf account 1.

This calculator helps you to estimate your total savings in epf when you retire. Calculate potential gains or risk losses from investing. To check how much you can withdraw please fill in your age and balance in your account 1. Our epf calculator will help you to estimate your employee provident fund epf corpus at the time of retirement.

How can you withdraw from epf to invest in epf members investment schemes mis. Home education epf calculator. Has myr 60 000 in his epf account. The pf calculator uses proprietary technology to fetch the correct sum.

The excess of basic savings in account 1 would be myr 13 000 the permitted withdrawal for member s investment will be myr 13 000 30 myr 3 900. Interest on the employees provident fund is calculated on the contributions made by the employee as well as the employer contributions made by the employee and the employer equals 12 or 10 includes eps and edli of his her basic pay plus dearness allowance da. You can withdraw up to 75 per cent of your epf account balance or three months basic wages or the amount that you actually need whichever is lower. Required basic savings level rm effective 1 january 2019 rm 00 00.

To facilitate epf members in preparing for a comfortable retirement the epf allows you to make a partial or full withdrawal from your savings to meet the specific retirement related needs that are in line with the epf s current policies. See all epf funds speak to our agents. You just need to enter the current balance of your epf account or pension fund account and your employer s contribution towards your epf account. Withdrawal age 50 home loan affordability.

Check eligibility check your eligibility.